The Convenience of Sending Money Online to Pakistan

Online money transfer is a game-changer in how we send funds around the world. It’s like having a digital magic wand that lets you move money across borders quickly and easily. Imagine sitting in your living room or on a bus, and with just a few taps on your smartphone or clicks on your laptop, you can send money to someone thousands of miles away. It’s that simple and fast, skipping the hassle of waiting in lines at banks or transfer agents.

But what really makes people trust online money transfers? It’s all about keeping your money safe. These services use some serious digital locks and alarms (think encryption and security protocols) to make sure your hard-earned money doesn’t fall into the wrong hands. And when it comes to your private info, they guard it like a treasure.

Here’s another cool thing: sending money online can be easier on your wallet. These services often have better exchange rates and lower fees than the old-school banks. If you’re sending money regularly, say to family back home, this can make a big difference. More of your money ends up where you want it to go.

And the options! Whether you’re sending a few pounds for a friend’s birthday or a larger sum for business, there’s a way to do it. Some services drop the money right into bank accounts, while others might put it in a mobile wallet or even have it ready for pickup in cash.

Take a place like Pakistan, where loads of families rely on money sent from relatives working in other countries. Services like TangoPay have stepped in, offering ways to send money that really fit what people there need. It’s not just about being quick; it’s about being thoughtful and understanding what works best for them.

To sum it up, online money transfers are like having a financial superhero in your pocket. They’re reshaping how we handle money across borders, making it faster, safer, and more tailored to our needs. In this connected world, that’s a big deal.

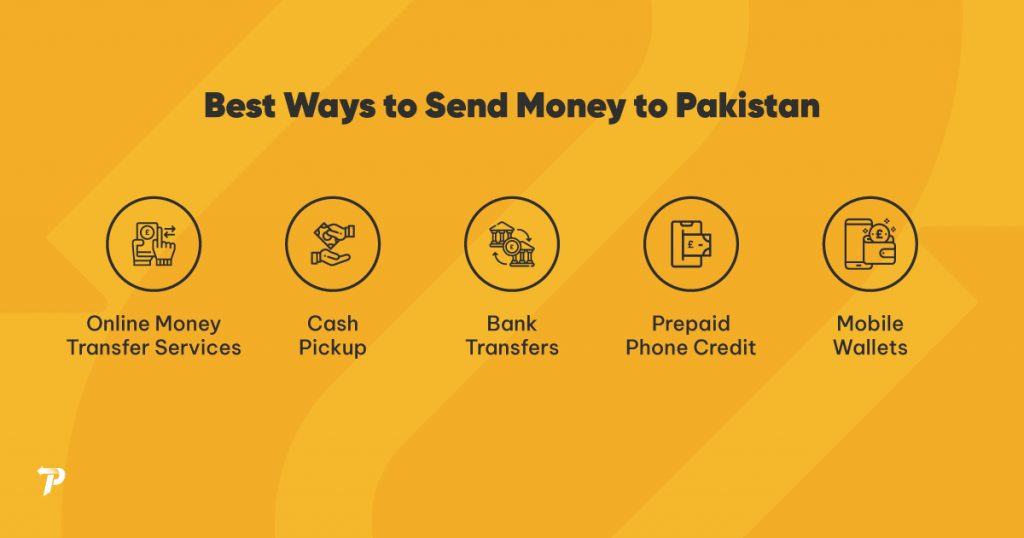

Best Ways to Send Money to Pakistan: A Friendly Guide

When considering the transfer of funds to Pakistan, it’s important to select a method that aligns with your needs in terms of cost, speed, and convenience. Here are some of the most efficient ways to send money:

Online Money Transfer Services:

These platforms are increasingly popular due to their competitive rates and lower fees compared to traditional banks. When exchanging currencies such as pounds or Pakistani rupees, these services offer a more cost-effective solution. They are ideal for those seeking a balance between affordability and convenience.

Cash Pickup:

This option is particularly useful for those who needs the money in cash or if the recipient does not have a bank account. It allows the recipient in Pakistan to collect the sent funds in cash from a designated agent location almost immediately. This method is a reliable choice for those needing to ensure prompt availability of funds.

Bank Transfers:

Transferring money via banks is a conventional method known for its reliability and security. However, it’s important to note that bank transfers can incur higher fees and may offer less favorable exchange rates compared to other options. For example, UK banks typically mark up exchange rates by about 3% to 6%.

Mobile Money:

Mobile money services represent a modern approach to money transfers. Users can send, receive, and store money using their mobile phones. This method is often favored for its quick processing and ease of use, making it a preferred way to transfer money to Pakistan online

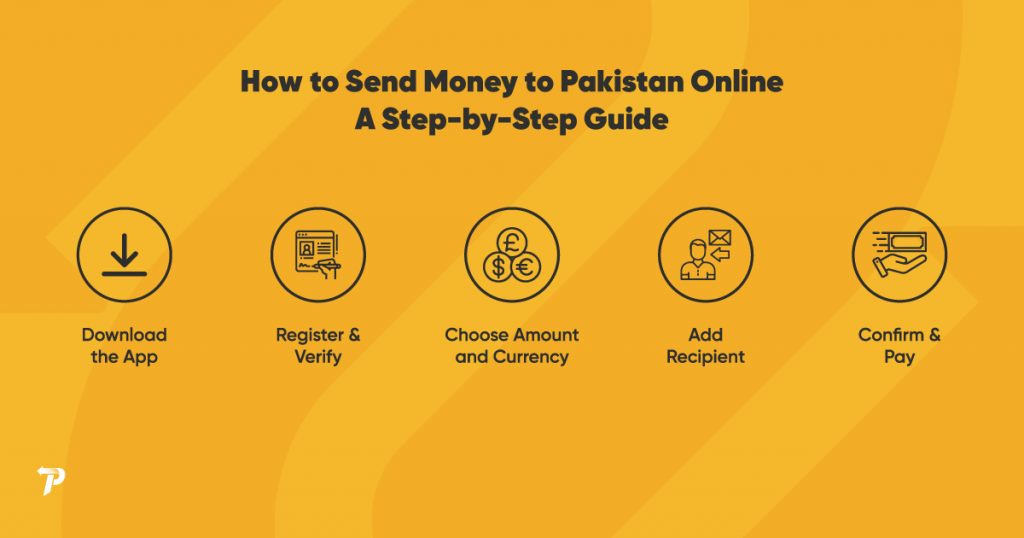

How to Send Money to Pakistan Online: A Step-by-Step Guide

Sending money to Pakistan online is straightforward, efficient, and secure. Whether you’re supporting family, managing property expenses, or conducting business, online transfers are a reliable way to get funds where they need to go. Here’s your step-by-step guide to ensure a smooth transaction:

Step 1: Choose Your Online Money Transfer Provider

First, select a reputable online money transfer service that operates in Pakistan, such as TangoPay. Look for factors like transfer speed, fees, exchange rates, and customer reviews to make an informed choice.

Step 2: Register and Set Up Your Account

Create an account with your chosen provider. You’ll typically need to provide personal information like your name, address, phone number, and a valid ID. Some services may require additional documentation for verification purposes, ensuring the security of your transactions.

Step 3: Enter Your Transfer Details

Once your account is set up, start the transfer process by specifying the recipient and the amount you wish to send. You’ll need to select the currency – in this case, Pakistani Rupees (PKR) – and enter the recipient’s details, including their name, bank details, and contact information.

Step 4: Review Fees and Exchange Rates

Before confirming your transfer, check the service’s exchange rates and fees. Look for transparency in their pricing to avoid any unexpected costs. A good service will provide a clear breakdown of the total amount your recipient will receive.

Step 5: Confirm and Pay for Your Transfer

After reviewing, confirm the transaction and choose your payment method. This could be a bank transfer, debit card, credit card, or other options provided by the service. Ensure your payment information is entered accurately to avoid delays.

Step 6: Track Your Transfer

Most services offer tracking capabilities, allowing you to see the status of your transfer in real-time. This feature gives you peace of mind and keeps you informed every step of the way.

Tips for a Smooth Transaction:

Double-Check Recipient Information:

Ensure all details, especially the recipient’s bank information, are correct to avoid delays or misdirected funds.

Understand the Timing:

Be aware of the transfer’s expected completion time, especially for urgent transactions.

Stay Informed About Exchange Rates:

Keep an eye on currency fluctuations, as they can affect the amount your recipient receives.

Keep Your Receipt:

Always save your transaction receipt or confirmation number until the recipient confirms they have received the funds.

Contact Customer Support if Needed:

Don’t hesitate to reach out to customer service for any questions or issues.

By following these steps and tips, you can ensure a hassle-free experience when sending money to Pakistan online. Remember, the key to a smooth transaction lies in choosing the right service provider and staying informed throughout the process.

Fastest Way to Send Money to Pakistan with TangoPay

When speed is essential in sending money to Pakistan, online providers like TangoPay offer a swift solution, sometimes at a higher cost for added convenience. Here’s a glimpse at how fast you can expect your money to reach Pakistan with TangoPay:

TangoPay – Transfers Within Minutes

The time it takes for your money to reach Pakistan can vary based on factors such as the amount being sent, the payment method, and the currency involved. TangoPay, a reputable provider in the realm of international money transfers, stands out for its ability to deliver competitive rates without hidden fees.

With TangoPay, customers can enjoy same-day transfers at a fraction of the cost compared to traditional banking methods, which are often pricier and slower.

How TangoPay Streamlines Sending Money to Pakistan

TangoPay, recognised as a leading international money transfer service, facilitates fast, secure, and hassle-free transfers to Pakistan in a variety of currencies. Here’s how you can use TangoPay to send money:

Register with TangoPay:

First, you need to sign up. This can be done either through their app or on their website. You’ll be asked for basic details like your name, address, and phone number. They will ask you for a quick ID scan. Once registered, you’re all set to start your transactions.

Initiate Your Transfer:

Select the recipient and the currency you wish to send. TangoPay offers several currency options, including the Pakistani Rupee (PKR). Simply choose Pakistan as your destination country and enter the amount you want to send.

Review TangoPay’s Rates and Fees:

Before confirming your transaction, take a moment to look at TangoPay’s competitive exchange rates and transparent fee structure. This helps you understand the total cost of your transfer, whether you’re sending GBP to PKR or any other currency pair.

Stay Informed:

After initiating your transfer, TangoPay keeps you updated on its progress. Once you’ve entered your payment details and clicked “send,” you can track the transfer, giving you peace of mind about your money’s security and arrival.

Transfers via TangoPay typically reach Pakistan within a few minutes, depending on the timing of the transaction.

This streamlined process, combined with TangoPay’s commitment to speed and transparency, makes it an excellent choice for those needing to send money to Pakistan quickly and securely.

Safety Measures and Fraud Prevention in Online Money Transfers

When sending money to Pakistan online, ensuring the safety of your transactions and preventing fraud is paramount. Online transfer services have implemented various measures and offer additional features to safeguard your money and personal information. Here’s a look at some key safety measures and fraud prevention strategies:

Encryption and Secure Connections:

Reputable money transfer services use strong encryption to protect your data during transmission. This means that any information you send is securely encoded, preventing unauthorized access.

Two-Factor Authentication (2FA):

Many services have implemented 2FA, requiring you to provide two forms of identification before accessing your account or completing a transaction. This could include something you know (like a password) and something you have (like a mobile phone for a one-time code).

Fraud Monitoring Systems:

Advanced monitoring systems are in place to detect unusual activity. If a transaction looks suspicious, the service may flag it for review or contact you to confirm its legitimacy.

User Verification Processes:

To prevent fraud, services often require users to verify their identity through documentation, such as government-issued IDs or utility bills. This helps to ensure that accounts are legitimately opened and used.

Secure Payment Methods:

Offering secure and diverse payment methods, like bank transfers, credit cards, and online wallets, ensures that users have safe options to fund their transactions.

Customer Education:

Many services provide resources to educate customers about safe practices, recognizing scams, and protecting their accounts.

Dedicated Customer Support:

Access to responsive customer support can be crucial, especially if you suspect fraudulent activity or have security concerns.

Additional Features and Services Offered by Online Transfer Services

Aside from these security measures, online money transfer services often offer additional features and services for an enhanced user experience:

Real-Time Tracking:

Users can track the progress of their transactions in real-time, offering peace of mind and transparency.

Rate Alerts and Currency Tools:

Services may offer tools to track currency exchange rates, allowing users to transfer money when rates are favorable.

Multiple Delivery Options:

Many services provide various delivery options like direct to bank deposits, cash pickups, mobile wallet transfers, and more, catering to different needs.

Regular Transaction Summaries:

Some services offer regular summaries or statements of your transactions, helping you keep track of your financial activities.

Recurring Transfer Options:

For those who send money regularly, some services offer the option to set up recurring transfers, saving time and effort in future transactions.

Multi-Language Support:

To cater to a diverse user base, many online transfer services offer support and interface options in multiple languages.

By leveraging these safety measures and additional features, online money transfer services ensure that sending money to Pakistan is not only convenient but also secure and reliable. As a user, staying informed and vigilant about these aspects can significantly enhance the safety and efficiency of your transactions.

What precautions should I take when sending money to Pakistan online?

When sending money to Pakistan online, there are several precautions you should take to ensure your transaction is secure and successful. Firstly, choose a reputable and reliable money transfer service. Look for well-established providers, have good user reviews, and are compliant with financial regulations.

Protecting your personal information is crucial. Be careful with your account details and passwords, and avoid sharing sensitive information over public Wi-Fi networks. Instead, use a secure, private internet connection for your financial transactions.

Always verify the recipient’s details thoroughly. Double-check their name, bank information, and contact number to prevent mistakes and ensure your money reaches the correct person.

Stay alert to the possibility of scams. Phishing emails or calls that request your account details are common tactics used by fraudsters. Remember, legitimate financial services will never ask for sensitive information like your password or PIN via email or phone.

Being aware of the exchange rates and fees associated with your transaction can help you choose the most cost-effective method and time for sending money. It’s also important to keep all records of your transactions, such as receipts or confirmation numbers until the recipient has confirmed receipt of the funds.

Ensure that your computer or mobile device is protected by keeping it updated with the latest security software. This helps guard against potential threats and vulnerabilities.

If you encounter any issues or have queries, having easy access to customer support from your money transfer service is essential. A responsive support team can provide assistance and help resolve problems quickly.

Lastly, educating yourself about the latest security practices and fraud prevention strategies is vital. Many online money transfer services provide useful resources and tips for safe transactions.

By taking these measures, you can enhance the safety of your online money transfers to Pakistan, ensuring that your money is sent securely and arrives at its intended destination without any issues.

FAQs

What is the best way to send money to Pakistan?

The best method depends on your needs but generally includes online money transfer services known for their low fees, competitive exchange rates, and fast transaction times. It’s advisable to compare different services for the best fit.TangoPay offers best rates and other bonuses.

Can I send money to Pakistan online?

Yes, you can send money to Pakistan online using platforms such as money transfer services and banking apps known for their convenience and security.

What is the use of online money transfer?

Online money transfers are used for quick and secure cross-border transactions. They are ideal for supporting family, managing international transactions, or paying for services overseas.

How to transfer money online in Pakistan?

To transfer money online in Pakistan, choose a reliable service, create an account, enter transfer details including amount and recipient information, and confirm the transaction. Most services offer real-time tracking and require keeping transaction records.